The Urban Consumer Price Index (CPI) is stabilizing, according to data released today by the Bureau of Labor Statistics (BLS) for May 2020. Prices declined by only 0.1% in May, compared to the more dramatic declines of 0.4% and 0.8% in March and April, respectively. Over the last 12 months, the all items index increased 0.1 percent before seasonal adjustment.

The CPI is the standard measure of the U.S. level of inflation. Most economists agree that a healthy economy should experience a stable, modest and positive level of inflation. Negative inflation (deflation) is considered an indicator of a struggling economy. Thus, this report of inflation heading toward positive territory is good news.

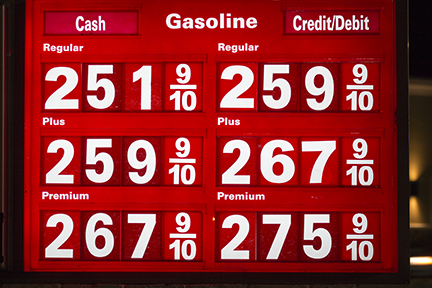

The big losers in May prices were Fuel Oil (-6.3%), Transportation Services (-3.6%), Gasoline (-3.5%) and Apparel (3.5%). The big winner in May was Food and Home with a positive 1% price increase, bolstered by increased demand that was driven by the stay at home orders.

The Consumer Price Index measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers. The all urban consumer group represents about 93 percent of the total U.S. population, therefore it is considered a reasonably accurate representation of the behavior of prices nationwide.

By Craig R. Everett, PhD. Opinions are solely my own. To follow me or add me as a friend on Bigwigg, visit my Profile Page. Please join my discussion group on Bigwigg.

Dr. Everett is a finance professor at the Pepperdine Graziadio Business School, where he teaches entrepreneurial finance and private capital markets.

Get involved!

Get Connected!

Come join the Bigwigg community of patriots! Expand your network and express yourself.

Comments